Peter Hillyard, Client Operations Manager at DOS & Co., discusses the government consultation on reforming construction retentions. Retention Protection is proposed with the UK Retention Deposit Scheme as a market ready solution if this is the preferred option.

The Department for Business & Trade is consulting on major changes to retentions in construction. The consultation runs until 23 October 2025. This is a once-in-a-generation opportunity to secure fair treatment for contractors and subcontractors. The consultation proposes two options for retentions:

- Banning Retentions Clauses altogether in construction contracts so that no more retentions will be held.

- Requiring Retention Protection in a segregated bank account or through a bond or guarantee.

The scale of the problem

Over £4.5 billion is withheld in retentions across the UK construction sector each year. While originally intended to incentivise quality and provide recourse for defects, in practice retentions have become a source of serious financial strain for SMEs. According to Government-backed research, 44% of contractors have lost retention funds due to upstream insolvency, and over 70% have experienced late or non-payment.

Retentions are often withheld without justification, delayed well beyond agreed periods, or lost entirely when employers or tier-one contractors collapse. With construction margins already under pressure, this misuse of retentions can represent the difference between solvency and insolvency for smaller firms.

The Government’s consultation rightly identifies these issues as systemic. But we believe that abolishing retentions outright would drive the problem underground.

Why abolition isn’t the answer but a blended approach is

Concerns have been raised that banning retentions entirely would not solve the underlying issues, and may even make them worse. In the absence of formal retentions, employers may respond by undervaluing interim payments or tightening the criteria for practical completion. These alternative behaviours are harder to monitor and regulate, but have the same net effect: withholding money from the supply chain.

Moreover, alternative instruments such as insurance or performance bonds are costly, slow to pay out, and impractical for smaller projects. Rather than replace retentions, our proposal is that they are properly safeguarded – ensuring the funds remain available when due, without imposing additional cost or bureaucracy.

We are recommending a blended legislative model, combining prohibition and protection in a proportionate way. Under the proposal:

- Retentions would be prohibited on contracts below £100,000, where the amounts withheld offer minimal practical benefit but create serious cashflow strain.

- For contracts over £100,000, retentions would remain permitted, but only if safeguarded in a third-party, FCA-regulated account.

This structure ensures SMEs are shielded from unnecessary risk, while maintaining a level playing field for employers seeking protection against defective works. It also allows the supply chain to plan with certainty, knowing that retention funds are ring-fenced and accessible when due.

What is the UK Retention Deposit Scheme?

The UK Retention Deposit Scheme is an independent, trust-based scheme for the protection of construction retentions in the United Kingdom.

It is run by DOS & Co., a legal and payment services firm that provides unrestricted legal services, escrow services and regulated payment services. DOS & Co. Ltd., the scheme provider, is registered in England and Wales, and is also registered with the Financial Conduct Authority for the provision of payment services.

For the Retention Deposit Scheme, DOS & Co. works as escrow agent, opening an account on behalf of the Employer, in their name at the Bank of London (the tech provider) which holds the funds at the Bank of England.

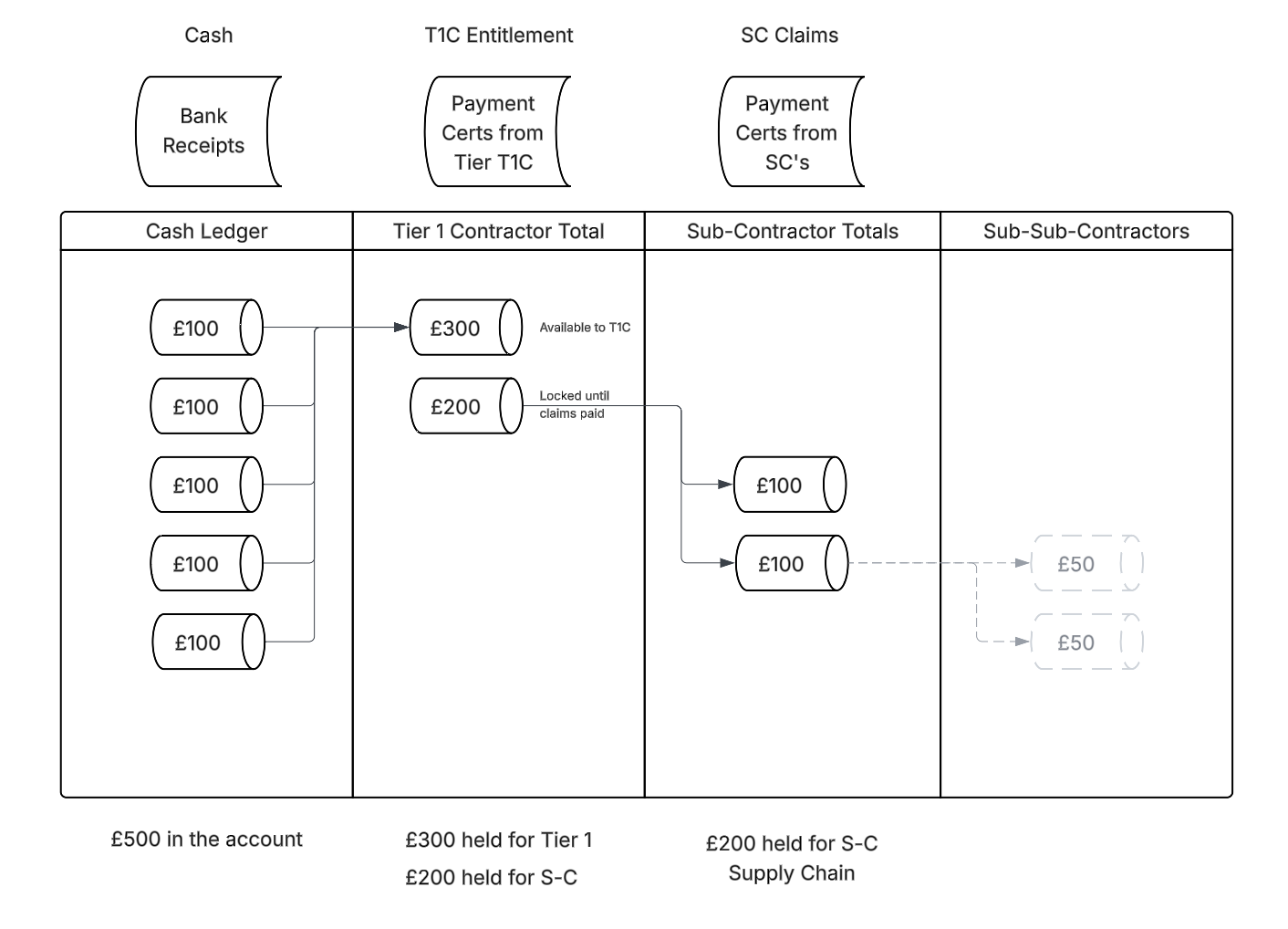

Each construction contract is its own account, which is sub account from the main scheme account. These are both segregated and safeguarded accounts with a unique sort code and account number, so the Employer pays the retention to a specific account under each contract.

UK Retention Deposit Scheme – Trust Waterfall

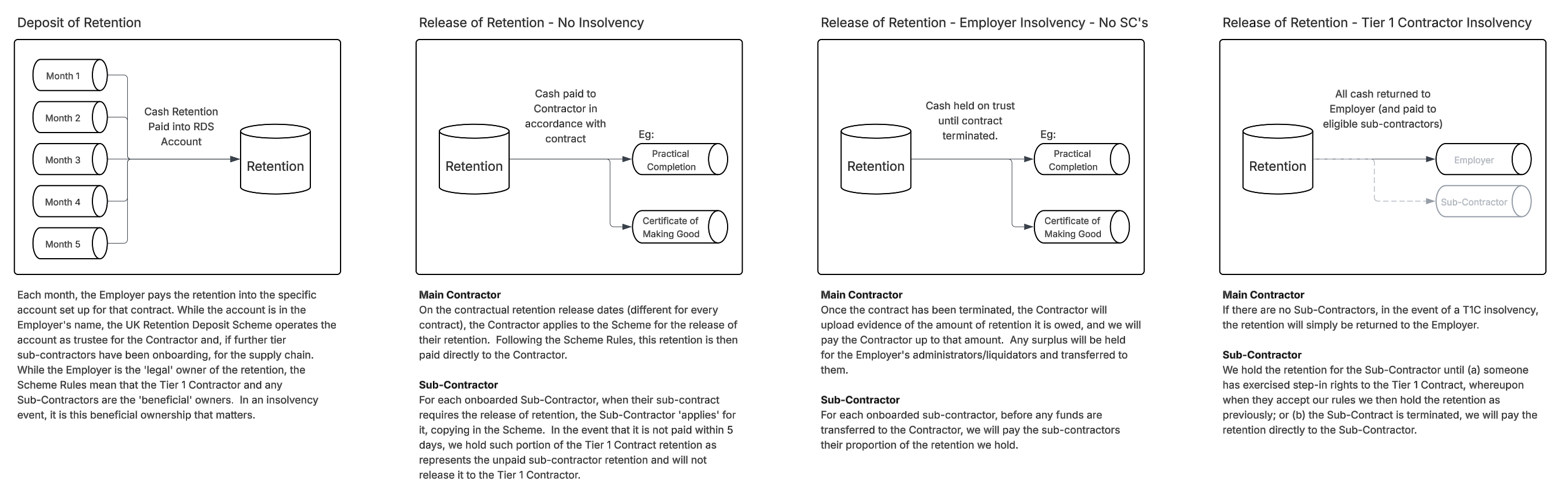

UK Retention Deposit Scheme – Deposit & Release

A market-ready solution

The UK Retention Deposit Scheme provides the very protection the Government is seeking to introduce. Regulated by the FCA and operated by an authorised payment institution, UKRDS safeguards all deposited funds at the Bank of England. Each project has its own uniquely addressed account, with sort code and account number, ensuring full transparency and auditability.

Once a practical completion certificate is uploaded, funds can be released automatically or, in the event of a dispute, by adjudicator instruction, meaning retentions are paid promptly when due. For contractors and subcontractors, this eliminates the need to chase payments; for employers, it ensures legitimate defects can still be rectified.

Critically, the Scheme has been designed to operate at low or zero cost. When the Bank of England base rate is at or above 3.75%, UKRDS operates without charge. In lower-rate environments, the only cost is a modest monthly fee of £25 per contract per month.

Benefits of the UK Retention Deposit Scheme

For Employers: Using retention deposit account for your construction retentions enhances security, transparency, and administrative efficiency, while reducing risks and promoting timely project completion.

For Contractors: Securing retentions against the Employer’s inability to pay and ensuring their prompt release is of paramount concern to contractors undertaking construction works in the UK.

For Sub-Contractors: As a Sub-Contractor (or sub-sub-contractor), you take the most credit risk in the construction supply chain. The insolvency of the Employer, someone you may know little about and have no direct access to, could mean that your Contractor does not receive their retention, and therefore lead to trouble with you recovering yours.

How the UK Retention Deposit Scheme manages these retentions deposits

Step 1: Open an Account

- Open a self-service account via our Portal

- Upload your construction contract

- Supply the paying party compliance information

- Receive dedicated account details for your Retention Deposit Account

Step 2: Deposit Retentions

- In accordance with the contract’s payment provisions, the paying party deposits the withheld retention each month in the Retention Deposit Account

- Upload the payment certificate

- Upload the invoice

- The paying party deposits the withheld retention each month in the Retention Deposit Account

Step 3: Verify Retentions

- Access your account portal 24/7 to check on your retention.

- Access your safeguarding certificate

- Confirm you’ve received your retentions

- Request release of your retentions

Step 4: Release of Retentions

- Your retentions are released in accordance with the terms of your construction contract and with the Scheme Rules

- Release against PC Certificate

- Release against Certificate of Making Good

- Release against court order enforcing adjudicator’s decision

A call to government and industry

The Scheme’s submission concludes with a call to action. With a functioning, tested, and regulated solution already in place, the Government has a unique opportunity to legislate with confidence. By mandating retention protection via trusted custodians, the sector could eliminate the scourge of lost and delayed retentions overnight.

“We are ready to support Government, employers, and contractors in embedding fairer, safer payment practices,” a spokesperson for the Scheme commented. “The infrastructure is in place, the regulation is robust, and the need has never been clearer.”

To complete a submission to the consultation visit: https://ditresearch.eu.qualtrics.com/jfe/form/SV_0v37vzvBpfM5Exw

For more information or to schedule a demonstration, visit: www.retentiondepositscheme.org

You can view the online version of our submission here: www.retentiondepositscheme.org/dbt-retentions-consultation-2025

The FIS draft response to the consultation has been made available to all members and is available via iainmcilwee@thefis.org. FIS acknowledges that whilst abolition is on the surface the simplest option, it would need control measures to support. Protection would potentially offer a viable alternative to abolition, but again would need some controls in place to support the supply chain.